- Contact Us

- News & Media

- Let’s Grow !!!

-

About Us

-

Partners

-

Services

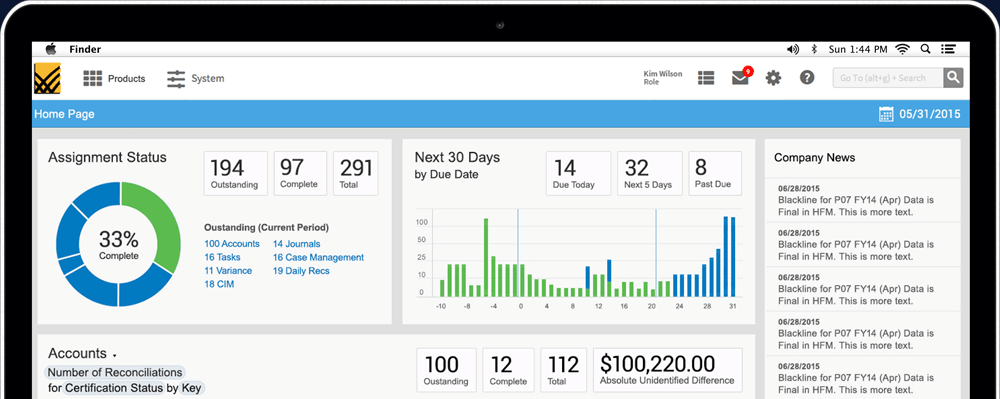

See what BlackLine can do for you.

BlackLine is a leading provider of Enhanced Financial Controls and Automation (EFCA) software and the only one offering a unified cloud platform to support the entire close-to-disclose process. BlackLine's EFCA platform helps midsize companies and large enterprises improve the accuracy and reliability of their financial reporting, achieve process efficiencies and improve visibility into their Finance & Accounting (F&A) operations.

The platform enables customers to move beyond outdated processes and point solutions to a "Continuous Accounting" model. With Continuous Accounting, real-time automation, controls and period-end tasks are embedded within day-to-day activities, allowing the rigid accounting calendar to more closely mirror the broader business.

Delivered through a scalable and highly secure cloud model and built from a single code base, the BlackLine platform supports many key F&A processes including the financial close, account reconciliations, intercompany accounting and controls assurance, fueling confidence throughout the entire accounting cycle. Through BlackLine's cloud analytics software, CFOs access real-time data to benchmark, analyze and improve the efficiency and performance of their F&A organizations.

In an era of ever-increasing business complexity, BlackLine's platform is purpose-built to transform and modernize mission-critical F&A processeswith enterprise-grade accuracy, automation and transparency. More than 135,000 users across 1,400 companies in approximately 100 countries depend upon BlackLine to increase accountant productivity and elevate controls and compliance functions to Modern Finance status.

BlackLine products are seamlessly integrated to manage every element of reconciliations and the financial close, working in unison to eliminate manual spreadsheet-dependent processes prone to human error.

Standardize, control & streamline reconciliations

BlackLine Account Reconciliations automates and standardizes the reconciliation process. It drives accuracy in the financial close by providing accountants with a streamlined method to verify the correctness and appropriateness of their balance sheets. Accountants can quickly compare general ledger, bank, and other data, investigate discrepancies, attach supporting documentation, and take required actions from an intuitive, unified workspace

Centralize, manage & automate journal entries

BlackLine Journal Entry provides a complete journal entry management system that enables you to create, review, and approve journals, then electronically certify and store them with all supporting documentation. Journals can be posted to the general or sub ledger systems with pre-posting validation to catch entry or logic errors, eliminating ledger rejections. Automation rules allow period-end journal entries to be created and populated based on data and rules, and posted automatically, eliminating considerable manual period-end work.

Match & reconcile millions of transactions in minutes

High-volume reconciliations can be some of the most time-consuming and painful components of the period-end close process. BlackLine Transaction Matching streamlines and automates detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching – all in one centralized workspace.

Visibility and control for any accounting checklist

BlackLine Task Management provides a configurable, web-based command center where you can manage accounting and finance tasks. Utilizing a hierarchical task list, role-based workflow, and real-time dashboards, the task management product allows users to track and control a variety of task types, including month-end close checklists, PBC lists, tax filings, and more.

Reduce risk with automated fluctuation analysis

BlackLine Variance Analysis automates the monitoring and analysis of account balance fluctuations using customer-defined rules. It provides efficiency, visibility and enhanced controls by identifying accounts whose balances fall outside of configurable thresholds so that these fluctuations can be properly investigated.

Automate system to system reconciliation

For companies with multiple systems rolled up through a consolidation system, BlackLine Consolidation Integrity Manager automates the tedious system-to-system reconciliation process. By integrating with systems, bringing data into a centralized location, and providing an automated workflow to investigate discrepancies, Consolidation Integrity Manager replaces the manual process of comparing multiple ledgers to a consolidation system.

Automate frequent reconciliations for continuous control and validation

Ensuring the validity of the balances of bank, credit card, lockbox, and other key accounts is a constant struggle for accounting teams. Associated complexities coupled with period-end time constraints mean critical steps are often ignored. Manually ticking and tying large datasets across spreadsheets lacks control and increases the risk of an error or material weakness. BlackLine Daily Reconciliations enables continual monitoring of accounts for accuracy throughout an accounting period by automating these more frequent, labor-intensive reconciliations.

BlackLine's Finance Controls and Automation Platform meets the needs of all types of companies, no matter what size they are or where they operate in the world. The company's proven hosted environment enables clients across the globe to complete their month-end tasks in one integrated environment.